does earnest refinance sallie mae loans your guide to student loan refinancing

Does earnest refinance sallie mae loans is a question many borrowers ask when searching for relief from hefty student loan payments and inflexible terms. If you’re navigating the world of student loan refinancing, knowing exactly how Earnest can handle Sallie Mae loans might be the game-changer you need for your financial future.

Sallie Mae offers a range of private student loans known for their flexible borrowing limits but sometimes less flexible repayment options. Earnest, on the other hand, is a well-known refinancing lender that can help you secure better rates and terms by consolidating your student debt—including Sallie Mae loans—into a single, manageable payment. In this guide, we’ll explore the eligibility requirements, application process, benefits, and potential limitations when refinancing your Sallie Mae loans with Earnest, plus compare alternatives to help you find the perfect fit for your needs.

Understanding Sallie Mae Loans

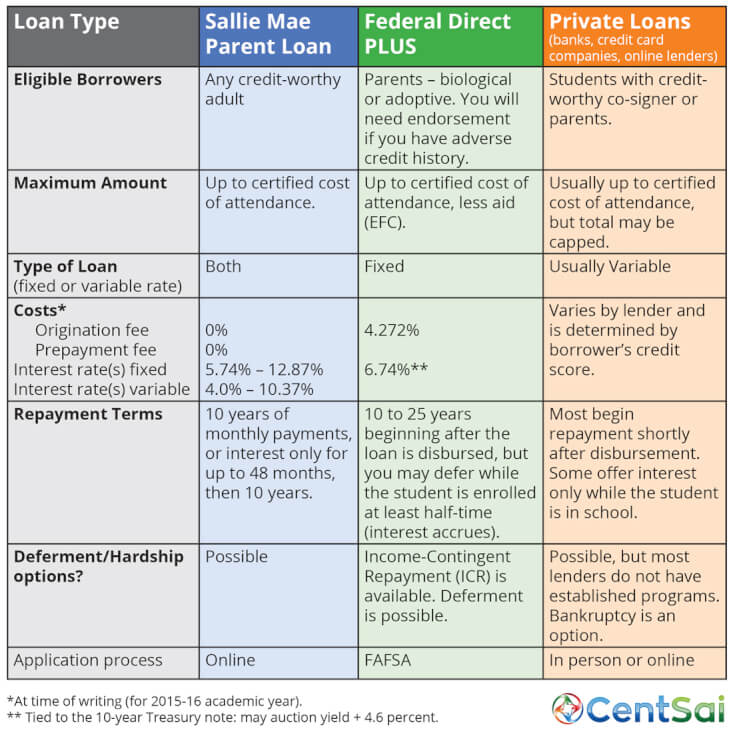

Sallie Mae is a major private lender in the student loan industry, known for offering a variety of student loans tailored to different educational needs. Unlike federal loans, Sallie Mae loans are not backed by the government but are designed to help bridge the gap when federal loans and other financial aid do not cover the full cost of college. Understanding the types, requirements, and the pros and cons of these loans is essential for anyone considering refinancing or managing student debt.

Types of Loans Offered by Sallie Mae and Their Main Features

Sallie Mae provides multiple loan options for students, parents, and graduate students. Each loan type comes with its own set of features designed to accommodate various academic pursuits and financial circumstances.

- Undergraduate Student Loans: Fixed or variable interest rates, flexible repayment options, and multi-year approval for qualified applicants.

- Graduate Student Loans: Specialized loans for graduate, MBA, law, and medical school, often including higher loan limits and longer repayment terms.

- Parent Loans: Loans offered directly to parents or sponsors who wish to help pay for their student’s education, with flexible repayment options.

- Career Training Loans: Loans for professional training and non-degree certificate courses, with fast application processes and competitive rates.

Eligibility Criteria for Borrowers of Sallie Mae Loans

To qualify for a Sallie Mae loan, applicants must meet specific requirements. These are designed to assess creditworthiness and ensure responsible lending.

- Applicants must be U.S. citizens or permanent residents, or apply with a creditworthy cosigner who meets this requirement.

- Borrowers must be enrolled at least half-time in a participating school.

- Satisfactory credit history and sufficient income (or a cosigner with these qualifications) are required.

- Borrowers must be of legal age in their state or have a cosigner who is.

Advantages and Disadvantages of Sallie Mae Loans

Choosing a private lender like Sallie Mae offers flexibility but also comes with certain trade-offs. The following table summarizes the key advantages and disadvantages of Sallie Mae loans, helping borrowers weigh their options more effectively.

| Advantages | Disadvantages |

|---|---|

| Flexible loan options for undergraduate, graduate, and career training programs | Interest rates may be higher compared to federal loans for some borrowers |

| Availability of multi-year approval for qualified applicants | Lack of federal protections such as income-driven repayment or forgiveness |

| Cosigner release option after making a set number of on-time payments | May require a creditworthy cosigner for approval |

| Customizable repayment options, including in-school deferment | Variable rates can increase over time, raising total repayment cost |

Overview of Earnest as a Refinancing Lender

Earnest has established itself as a reputable fintech company specializing in student loan refinancing. Since its founding in 2013, Earnest has been recognized for its innovative approach, customer-friendly digital platform, and flexible loan terms. Understanding Earnest’s background and services can help borrowers determine if refinancing through Earnest is the right choice.

Background and Reputation of Earnest

Earnest is known for its transparent lending practices and commitment to borrower flexibility. The company has received positive reviews for its seamless online application process and competitive rates, making it a solid choice in the student loan refinancing space.

- Founded in 2013 and headquartered in San Francisco, CA.

- Acquired by Navient in 2017, expanding its reach and resource base.

- Consistently rated highly by borrowers for customer support and customization options.

Types of Loans and Borrowers Served by Earnest

Earnest serves a wide range of borrowers, primarily focusing on those looking to refinance existing student loans—both federal and private. The company targets individuals with strong credit profiles and steady incomes but offers flexible qualification metrics compared to traditional banks.

- Refinancing for undergraduate and graduate student loans, including loans from Sallie Mae and other private/federal lenders.

- Parent PLUS loan refinancing, allowing parents to transfer debt to their own names or to the student.

- Borrowers with diverse educational backgrounds and career paths, not limited to specific schools or degree types.

Unique Features in Earnest’s Refinancing Process

What sets Earnest apart is its focus on personalization and technology-driven solutions. Borrowers benefit from a range of features designed to optimize the refinancing experience and repayment management.

- Customizable monthly payments with the ability to select any term between 5 and 20 years.

- No origination, prepayment, or late fees, making repayment more straightforward.

- Option to skip a payment once per year (with prior approval and conditions).

- Comprehensive online dashboard for managing loans and tracking progress.

Refinancing Process for Sallie Mae Loans with Earnest

Refinancing Sallie Mae loans with Earnest can help eligible borrowers secure better rates or more suitable repayment terms. The process is designed to be user-friendly, but it requires careful preparation and timely submission of all necessary documentation.

Step-by-Step Refinancing Procedure with Earnest

Navigating through the refinancing process with Earnest involves several distinct steps, each crucial for a successful application.

- Visit the Earnest website and use the online rate check tool to view personalized refinancing offers without impacting your credit score.

- Fill out the full application, providing personal, educational, employment, and financial information.

- Upload required documentation, including identification, proof of income, and details about current Sallie Mae loans.

- Review the final loan offer and sign the agreement if the terms are satisfactory.

- Earnest pays off your existing Sallie Mae loans directly, and your new loan with Earnest is established.

Required Documentation and Information for Refinancing, Does earnest refinance sallie mae loans

Having the correct documents ready helps streamline the application and approval process. Applicants should expect to provide the following:

- Government-issued ID (driver’s license, passport, etc.)

- Most recent pay stubs or proof of income

- Completed federal tax returns (typically for the previous year)

- Information about current student loans, including lender statements or payoff letters

- Bank statements or other documents verifying assets and debts

Timeline from Application to Approval

Knowing what to expect in terms of timing can help applicants plan effectively. The following table Artikels the typical steps and corresponding timeframes for refinancing with Earnest.

| Step | Description | Approximate Timeframe | Outcome |

|---|---|---|---|

| Rate Check | Soft credit inquiry for personalized refinancing rate | 5 minutes | View estimated rates with no credit impact |

| Full Application | Submit detailed application and upload documents | 30–60 minutes | Application moves to underwriting |

| Underwriting Review | Earnest reviews documents and verifies information | 3–5 business days | Receive final loan offer |

| Loan Disbursement | Sign loan agreement; Earnest pays off Sallie Mae | 3–10 business days | New loan with Earnest is active |

Eligibility Requirements for Refinancing with Earnest

To refinance Sallie Mae loans with Earnest, borrowers must meet certain eligibility standards. These requirements ensure that applicants have the financial stability and credit history needed for responsible repayment and successful loan management.

Specific Eligibility Criteria Set by Earnest

Earnest evaluates several factors when reviewing refinancing applications. The company uses a holistic approach, considering not only credit scores and income but also monthly cash flow and savings.

- Minimum credit score of 650 (though most approved borrowers have higher scores).

- Consistent employment or a verifiable job offer with a start date within six months.

- Proof of sufficient income to cover expenses and new loan payments.

- U.S. citizenship or permanent residency status.

- No bankruptcy or recent delinquencies on credit record.

Eligibility Differences Between Earnest and Other Major Refinancing Lenders

Different lenders apply distinct criteria for refinancing approval. Below is a comparative list highlighting how Earnest’s requirements may differ from competitors like SoFi, Laurel Road, and CommonBond.

- Earnest allows for a lower minimum credit score (650) compared to some competitors requiring 680 or higher.

- Unlike some lenders, Earnest considers cash flow and spending habits, not just credit score and income.

- Earnest does not require a degree from an eligible Title IV institution, while others may require graduation.

- Other lenders may have higher income minimums or more restrictive debt-to-income ratio thresholds.

Factors That May Affect Approval

Approval for refinancing is multifaceted, and many variables can influence the outcome beyond just credit score or income. Earnest’s holistic assessment provides flexibility but also requires comprehensive financial stability.

- Strong, positive credit history with no recent bankruptcies or defaults.

- Stable employment and verifiable, sufficient monthly income to meet obligations.

- Healthy savings or emergency fund to handle unexpected expenses.

- Reasonable debt-to-income ratio, taking into account all monthly obligations.

- Consistent payment history on current loans, demonstrating responsible management.

Final Wrap-Up: Does Earnest Refinance Sallie Mae Loans

Deciding whether to refinance your Sallie Mae loans with Earnest comes down to your personal financial goals and where you’ll get the most value. With its flexible payment options, user-friendly process, and competitive rates, Earnest stands out as a strong choice for many borrowers. Remember to compare all your options and consider both the short-term and long-term impact on your finances before making a move. Refinancing can be a smart step toward financial freedom when you’re well-informed and confident in your choice.

Helpful Answers

Can I refinance both federal and private Sallie Mae loans with Earnest?

Yes, Earnest allows you to refinance both federal and private Sallie Mae loans. However, refinancing federal loans with a private lender means you lose federal protections like income-driven repayment and loan forgiveness.

Will refinancing with Earnest affect my credit score?

Applying for refinancing includes a hard credit check, which may cause a slight, temporary dip in your credit score. Over time, on-time payments with your new loan can help improve your score.

How long does it take to refinance Sallie Mae loans with Earnest?

The process can take anywhere from a few days to a few weeks, depending on how quickly you submit required documents and how complex your loan situation is.

Does Earnest charge any application or origination fees?

No, Earnest does not charge application, origination, or prepayment fees for refinancing your student loans.

Can I add a co-signer when refinancing Sallie Mae loans with Earnest?

Currently, Earnest does not offer the option to apply with a co-signer. All applications are evaluated based on the individual borrower’s financial profile.