can you cancel claim car insurance everything you should know

Can you cancel claim car insurance is a question that often pops up for drivers who find themselves rethinking a filed claim. Whether you’re second-guessing your choices, discovered new information, or simply want to prevent a potential increase in your premiums, the curiosity about undoing a car insurance claim is more common than you might think. This topic uncovers some surprising realities and practical steps that might not be obvious at first.

From understanding what it means to pull back a claim after it’s already in motion, to walking through the actual process, this guide explains when, why, and how you can reverse a car insurance claim. There’s a lot to consider, including the timing, eligibility, possible impacts on your policy, and how different insurers handle cancellations. We’ll also shed light on misconceptions, real-life scenarios, and alternatives to simply canceling outright, equipping you with all the insights you need before making your next move.

Understanding Car Insurance Claims and Cancellations

Car Cancellation

Dear [Insurance Company Name],

I am writing to formally request the cancellation of my car insurance claim with reference number [Claim Number] for policy [Policy Number], filed on [Date]. After further consideration, I have decided not to pursue this claim and kindly ask for confirmation that the process has been terminated and my records updated accordingly.

Please let me know if any additional information is required.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Contact Information]

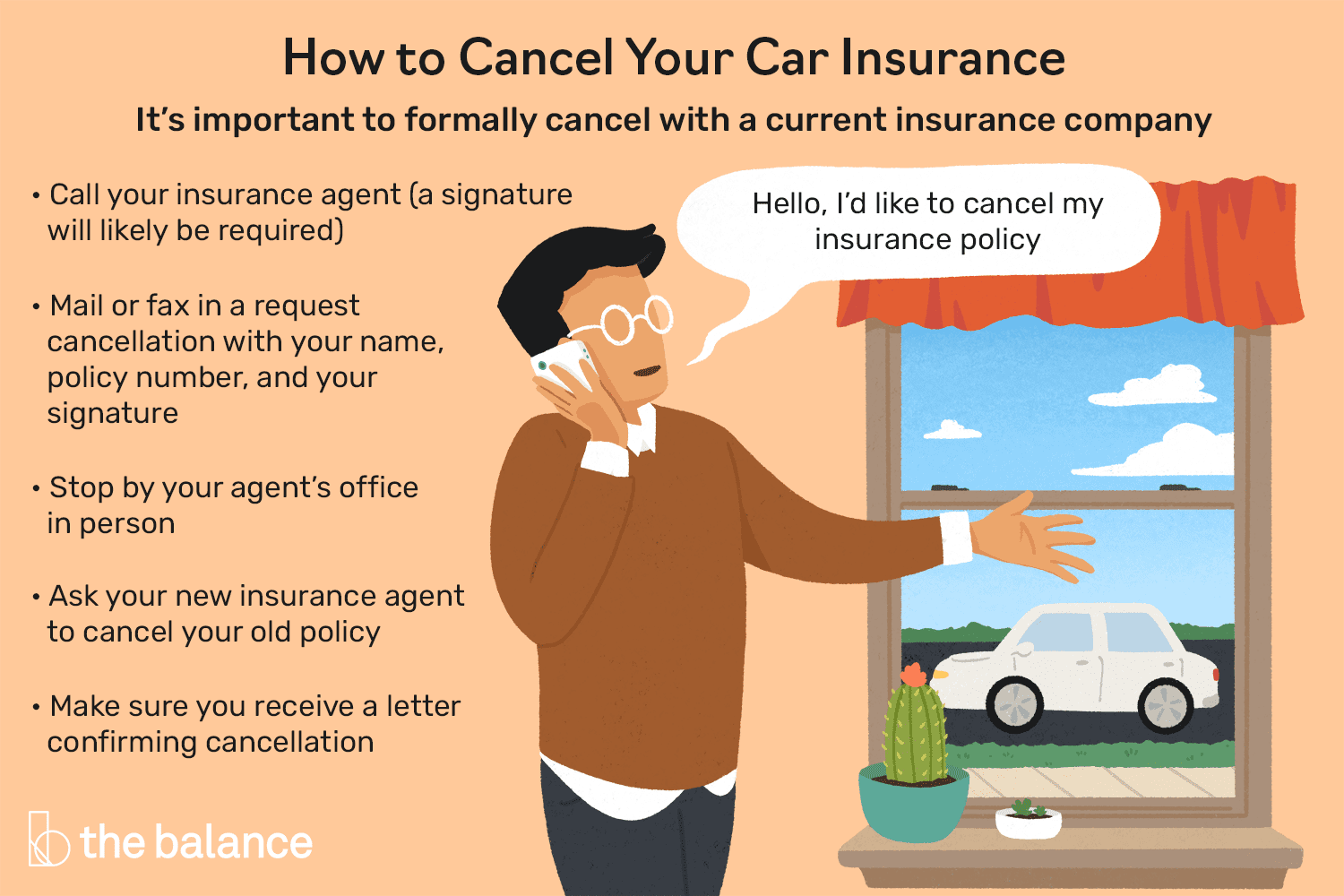

Tips for Documenting Communication, Can you cancel claim car insurance

Maintaining thorough records of your interactions with the insurance company is prudent. Keep copies of all correspondence—emails, letters, and notes from phone conversations—in an organized file. Always request and save acknowledgments or reference numbers for each action.

Alternatives to Cancelling a Claim

Sometimes, outright cancellation is not the only option. Policyholders may consider alternatives that better fit their circumstances, such as modifying claim details or negotiating settlements.

Options Available After Filing a Claim

If you have second thoughts after submitting a claim, consider:

- Requesting to amend claim details to reflect updated information or reduced damages.

- Withdrawing only part of the claim, such as excluding specific repair costs or damages.

- Negotiating a settlement with the insurer for a lower payout or different resolution.

Circumstances Where Withdrawing a Claim Is More Beneficial

In certain situations, withdrawing a claim may be preferable to complete cancellation. These include:

- If the repair cost is just above the deductible but you wish to avoid any claim record.

- When both parties agree to a private settlement instead of involving insurance.

- If the claim was filed in error or as a precaution but is no longer necessary.

Common Misconceptions about Cancelling Claims

There are several myths around the process and consequences of cancelling a car insurance claim. Clarifying these misunderstandings helps policyholders make decisions based on facts.

| Misconception | Fact | Explanation | Source/Authority |

|---|---|---|---|

| Cancelling a claim erases all records | Cancelled claims are still documented | Insurers typically retain a record of all claim activity | Insurance Information Institute |

| Premiums always increase after a cancelled claim | Premiums may not change if no payment is made | Cancellations before payout rarely affect rates | State insurance regulators |

| Cancelling a claim affects your driving record | Driving records are separate from insurance claims | Only claims involving traffic violations may impact your license | DMV guidelines |

| Canceling a claim is the same as claim denial | Cancellations are voluntary, denials are insurer decisions | Claim denial is initiated by insurer, cancellation by policyholder | NAIC (National Association of Insurance Commissioners) |

Real-life Scenarios and Case Studies

Examining real-life situations helps illustrate the nuances of cancelling car insurance claims and provides valuable lessons for policyholders.

Illustrative Case Studies on Claim Cancellations

Consider the following examples:

- A driver files a claim after a minor parking lot scrape, but the repair estimate is less than the deductible. They cancel the claim, and the insurer marks it as “withdrawn,” resulting in no premium change.

- An accident involving multiple vehicles leads to a claim. Before payout, the policyholder and the other party decide on a private settlement. The claim is cancelled, but the insurer notes the activity for recordkeeping.

- After submitting a claim for windshield damage, a policyholder learns their policy does not cover the damage type. They cancel, and the insurer closes the file without penalty.

Lessons Learned and Best Practices

From these scenarios, several key takeaways emerge:

- Always check your deductible and coverage before filing a claim to determine if it’s worth pursuing.

- Communicate promptly with your insurer about any changes or decisions regarding your claim.

- Keep comprehensive records of all claim-related correspondence and actions.

- Understand that each insurer may have unique policies; always verify procedures with your provider.

Variability in Insurer Responses to Claim Cancellations

Different insurance providers may handle similar cancellation requests differently, depending on company policy, state regulations, and internal risk assessments. Some may be more flexible about removing records of withdrawn claims, while others maintain a more detailed claims history. Knowing your insurer’s approach can help you navigate the process more effectively.

Closing Summary

Ultimately, knowing the ins and outs of can you cancel claim car insurance gives you the confidence to navigate tricky situations with your insurer. By weighing the possible outcomes, understanding the process, and recognizing when cancellation is the right move, you can make choices that protect both your wallet and your peace of mind. With the right knowledge, you’re prepared to handle your car insurance claims like a pro, no matter what curveballs come your way.

FAQ Resource: Can You Cancel Claim Car Insurance

Can I cancel a car insurance claim after it’s been approved?

It depends on the insurer and the stage of the claim. Often, if payment hasn’t been issued yet, you may still be able to cancel. Once payout is made, cancellation may not be possible.

Will canceling my claim affect my driving record?

Canceling a claim generally does not impact your driving record, as claims are separate from traffic violations or accidents reported to authorities.

Does canceling a claim remove it from my insurance history?

Many insurers will still record that a claim was filed and then withdrawn or canceled, so it may remain visible in your insurance history.

Do I need a specific reason to cancel my claim?

No, you can usually cancel for any reason, but it’s helpful to explain your decision to your insurer for clarity and proper documentation.

Is there a deadline for canceling a car insurance claim?

Yes, insurers typically have timeframes for cancellations, which can vary. It’s best to act quickly and check with your provider for their specific policy.