business inventories strategies for efficient management

Business inventories take center stage as the driving force behind operational excellence and competitive advantage. From bustling warehouses to sophisticated retail chains, mastering the art of inventory management is what separates thriving businesses from the rest. Whether you’re a seasoned entrepreneur or just curious about what happens behind the scenes, the story of business inventories is full of lessons waiting to be discovered.

At its core, business inventories refer to the goods and materials a company holds for the purpose of resale, production, or day-to-day operations. Effective inventory management ensures the right products are available at the right time, prevents costly shortages or surpluses, and has a direct impact on profitability. With a range of inventory types, management systems, valuation methods, and technologies, understanding this topic unlocks the secrets to streamlining supply chains and delighting customers.

Definition and Importance of Business Inventories

Business inventories refer to the goods and materials that a company holds with the purpose of resale, production, or day-to-day operations. They play a vital role in industries ranging from manufacturing to retail to services, providing the necessary resources to meet customer demand, maintain smooth operations, and support growth. Managing inventories efficiently is crucial for avoiding unnecessary costs and ensuring a balanced supply chain.

Inventories are significant assets for many businesses, directly affecting cash flow, production schedules, and customer satisfaction. Proper inventory management enables organizations to operate efficiently by reducing holding costs, minimizing stockouts, and optimizing order fulfillment. The approach to inventory varies across industries, but the fundamental goal remains the same: to have the right amount of product available at the right time.

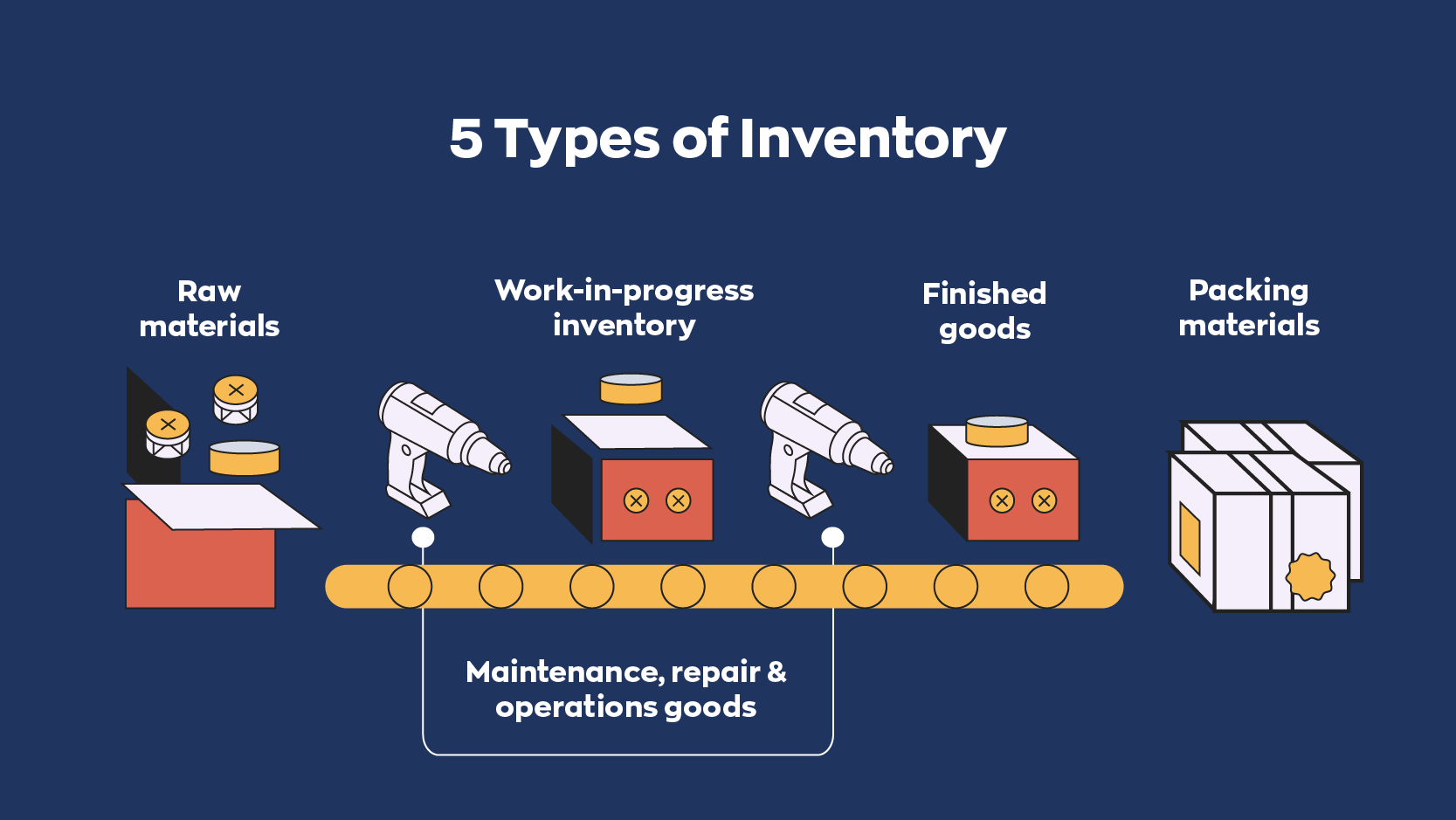

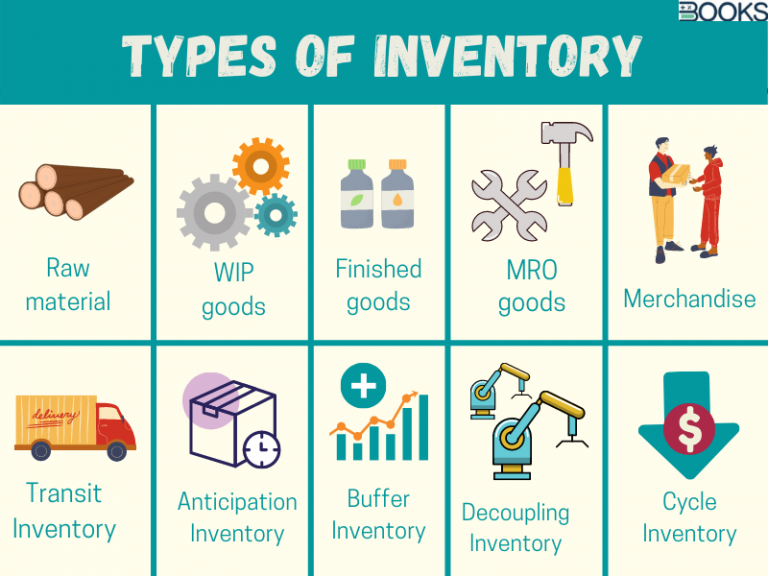

Types of Inventories Maintained by Businesses

Businesses manage a variety of inventory types, each serving a unique purpose in the production and sales cycle. Understanding these categories helps organizations develop tailored strategies for effective control.

- Raw Materials: Basic components or substances used in the manufacturing process before any transformation.

- Work-in-Progress (WIP): Items that are in the process of being manufactured but are not yet complete.

- Finished Goods: Products that have completed the manufacturing process and are ready for sale to customers.

- MRO (Maintenance, Repair, and Operations) Supplies: Items consumed in the production process but not part of the final product, such as lubricants, cleaning supplies, and spare parts.

Significance of Inventory Management for Operational Efficiency

Efficient inventory management is essential for optimizing operational workflows and reducing costs. By maintaining optimal stock levels, companies can streamline production, prevent delays, and respond quickly to market changes. This not only improves profitability but also enhances customer trust through reliable order fulfillment and consistent product availability.

Types of Inventory Management Systems

Inventory management systems are the backbone of a company’s ability to track, control, and optimize its stock. Over time, businesses have adopted various methodologies and tracking systems, each catering to different operational needs and industry requirements.

Major Inventory Management Methodologies

Inventory methodologies guide how stock is purchased, stored, and sold. Some of the most common approaches include Just-in-Time (JIT), First-In-First-Out (FIFO), and Last-In-First-Out (LIFO). Each methodology has its unique strengths and fits specific business scenarios:

- Just-in-Time (JIT): Inventory is ordered and received only as needed, minimizing holding costs. Most effective in industries with predictable demand and reliable suppliers.

- First-In-First-Out (FIFO): Oldest stock is sold first, which helps in keeping inventory fresh. Ideal for perishable goods or items affected by expiration dates.

- Last-In-First-Out (LIFO): Most recently acquired items are sold first. Often used where prices are rising, as it can reduce taxable income in certain jurisdictions.

Comparing Periodic and Perpetual Inventory Systems

Periodic and perpetual inventory systems determine how businesses track and update stock levels. The following table highlights key differences between these two systems:

| System Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Periodic | Inventory is physically counted at intervals (e.g., monthly, quarterly). | Lower upfront costs, simple to implement for small businesses. | Limited real-time visibility, higher risk of stockouts or overstock. |

| Perpetual | Inventory records are updated automatically with each transaction. | Real-time tracking, better analytics, improved accuracy. | Higher system and maintenance costs, requires more training. |

Manual and Automated Inventory Tracking Methods

Manual tracking involves physical counts and spreadsheets, making it best suited for businesses with limited inventory and simple operations. Automated methods leverage technology, such as inventory management software, barcode scanning, and real-time databases, providing higher accuracy and scalability as businesses grow.

Industries and Suitable Inventory Management Systems

The suitability of a management system depends on the nature of the business, product type, and operational complexity. Here are industry-specific recommendations:

- Just-in-Time (JIT): Automotive manufacturing, electronics assembly, and food processing.

- FIFO: Grocery stores, pharmacies, and fashion retail.

- LIFO: Hardware, construction materials, and petroleum sectors (where prices fluctuate).

- Manual Tracking: Small boutiques, local craft businesses, and startups with limited SKUs.

- Automated Systems: Large-scale e-commerce, logistics providers, and multinational distributors.

Inventory Valuation Methods

Inventory valuation is essential for determining the cost of goods sold and the value of remaining inventory, impacting financial statements and tax liabilities. Businesses choose from several common methods, each with distinct calculation approaches and financial implications.

Common Inventory Valuation Methods

Two frequently used methods are specific identification and weighted average cost. Understanding how each works helps organizations align their financial reporting with operational realities.

- Specific Identification: Tracks the actual cost of each individual item, ideal for unique, high-value, or low-volume goods (e.g., jewelry, vehicles).

- Weighted Average Cost: Calculates an average cost for all units available for sale, smoothing out price fluctuations, commonly used for bulk goods like grains or chemicals.

- FIFO: Assigns cost based on the order goods are received; the oldest items’ costs are assigned to sold units.

- LIFO: Assigns cost based on the most recent purchases, matching current costs to current sales in times of inflation.

Inventory Valuation Methods Comparison Table, Business inventories

The table below summarizes each method’s characteristics:

| Method Name | Calculation Approach | Financial Impact | Typical Usage Scenario |

|---|---|---|---|

| Specific Identification | Tracks individual item cost | High accuracy, best for unique items | Luxury retail, automotive, art dealers |

| FIFO | Oldest costs assigned to sold units | Higher profits in inflation, reduces obsolescence | Grocery, pharmaceuticals, perishable goods |

| LIFO | Newest costs assigned to sold units | Lower taxable income in inflation, higher COGS | Commodities, construction, metals |

| Weighted Average | Cost averaged across units | Smooths profit/loss fluctuations | Wholesale, chemicals, grain storage |

Impact of Valuation on Financial Statements

The chosen valuation method directly impacts the cost of goods sold, gross profit, and taxable income. For example, FIFO typically shows higher profits in periods of rising prices, while LIFO can provide tax advantages under the same conditions.

Calculating Ending Inventory Using FIFO

A step-by-step procedure for calculating ending inventory with FIFO:

- List all inventory purchases in the order received.

- Sum the units sold during the period.

- Assign the oldest inventory costs to units sold, leaving the most recently purchased costs for the ending inventory.

- Add up the cost of the remaining units based on their purchase price to determine ending inventory value.

For example, if 100 units were purchased at $10 and 100 more at $12, and 150 units were sold, FIFO assigns the $10 cost to the first 100 units and $12 to the next 50 units sold. The remaining 50 units are valued at $12 each.

Last Word

In summary, business inventories aren’t just a backroom concern—they’re a critical element that shapes every aspect of a company’s performance. By leveraging best practices, embracing technology, and staying ahead of regulatory requirements, businesses can transform inventory management from a challenge into an opportunity for growth and innovation. Keep optimizing, stay agile, and let your inventory work for you.

FAQ Insights: Business Inventories

What are business inventories?

Business inventories are goods and materials a company holds for manufacturing, resale, or supporting daily operations.

Why is inventory management important?

Inventory management helps businesses avoid overstocking or stockouts, reduces costs, and improves customer satisfaction.

How does inventory affect cash flow?

Too much inventory can tie up cash that could be used elsewhere, while too little can result in missed sales opportunities.

What is inventory turnover?

Inventory turnover measures how often a company sells and replaces its inventory over a specific period, indicating efficiency.

Can technology improve inventory accuracy?

Yes, using tools like barcode scanners, RFID, and inventory management software can significantly enhance tracking and reduce errors.