earnest loan reviews uncover honest borrower insights

With earnest loan reviews at the forefront, readers are invited on a journey that explores real borrower experiences, the ins and outs of the lender’s offerings, and what sets Earnest apart from its competitors. From the application process to repayment options, this review offers a comprehensive look behind the scenes, promising insights that go beyond surface-level details.

Earnest is a reputable financial institution specializing in student loans and loan refinancing, recognized for its flexible terms, transparent rates, and technology-driven service. This guide walks you through the features, eligibility, customer experience, real-life success stories, and how Earnest compares to other top lenders. Whether you’re considering refinancing existing loans or securing your first student loan, this review will help you make an informed decision.

Overview of Earnest Loans

Earnest is recognized in the lending industry for its innovative approach to student loans and refinancing, allowing borrowers more flexibility and control over their loan terms. Established in 2013, Earnest’s mission has focused on making education funding more accessible and manageable, leveraging technology to simplify the borrowing experience.

Earnest started as a tech-driven lender aiming to challenge traditional banks with more personalized lending options. Over time, it has grown into a major player in the student loan market, particularly for those seeking refinancing options with customizable terms and transparent pricing.

Main Features and Offerings

Earnest stands out for its customizable loan terms and unique underwriting process that considers factors beyond credit scores, such as savings patterns and career trajectory. The lender provides:

- Private student loans for undergraduate and graduate students

- Student loan refinancing for both federal and private loans

- Cosigner options for private loans

- No origination, prepayment, or hidden fees

- Flexible term lengths, allowing borrowers to choose their monthly payment and loan duration

History and Background of Earnest

Founded by Louis Beryl and Ben Hutchinson, Earnest quickly gained traction as a forward-thinking financial institution. Its acquisition by Navient in 2017 enabled Earnest to scale operations and continue developing borrower-friendly products. Today, Earnest uses data-driven assessments to offer loans to qualified applicants who might be overlooked by traditional lenders, emphasizing transparency and flexibility.

Types of Loans Provided by Earnest

Earnest’s offerings focus primarily on education financing solutions:

- Private Student Loans: Available to undergraduate and graduate students, offering multi-year approval and flexible repayment options.

- Student Loan Refinancing: Allows borrowers to combine multiple loans (federal and private) into one, potentially lowering their interest rates and simplifying payments.

- Parent Loans: Designed for parents who wish to help finance their child’s education, with the same flexible benefits as other Earnest loans.

Application Process and Eligibility Criteria

Applying for an Earnest loan is designed to be straightforward, leveraging digital tools to streamline each step. The lender emphasizes clarity regarding eligibility and documentation, ensuring borrowers understand what is needed before applying.

Step-by-Step Application Process

The application process for an Earnest loan involves several distinct stages, each focused on assessing the borrower’s profile and matching them with the most suitable loan terms:

- Prequalification: Complete an online form to check rates without impacting your credit score.

- Formal Application: Submit detailed personal, financial, and educational information through the Earnest portal.

- Document Submission: Upload required documentation such as proof of income, identification, and educational enrollment.

- Loan Offer Review: Receive and review loan offers tailored to your financial profile.

- Final Approval and Disbursement: Accept the offer, undergo a hard credit check, and finalize the loan agreement for funding.

Eligibility Requirements for Borrowers

Eligibility for Earnest loans is determined by a comprehensive review of financial stability—not just credit score. The most important criteria include:

- U.S. citizenship or permanent residency

- Enrollment at an eligible institution (for student loans)

- Demonstrated ability to repay, shown through income, savings, and employment history

- Minimum credit score requirement (typically 650 for refinancing)

- No bankruptcies or recent delinquencies

Key Application Details

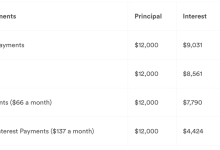

Understanding the essential requirements and expectations can help applicants prepare effectively. The following table summarizes critical data points:

| Required Documents | Minimum Qualifications | Interest Rate Ranges | Application Timeframes |

|---|---|---|---|

| Photo ID, proof of income, loan statements, enrollment verification | U.S. citizen/permanent resident, 650+ credit score | Variable: 5.19%–9.74% Fixed: 4.99%–9.99% (as of 2024) |

Prequalification: Minutes Full approval: 2–7 days |

Interest Rates, Fees, and Repayment Options: Earnest Loan Reviews

Borrowers choosing Earnest often prioritize transparency and control over their repayment journey. Earnest is known for competitive interest rates, minimal fees, and a range of repayment choices.

Comparison with Other Major Lenders

To understand how Earnest stacks up against other well-known lenders, consider the following comparative table:

| Lender | Fixed Rate | Variable Rate | Fees |

|---|---|---|---|

| Earnest | 4.99%–9.99% | 5.19%–9.74% | $0 origination, $0 prepayment, $0 late fee |

| Sofi | 5.24%–9.99% | 5.29%–9.74% | $0 origination, $0 prepayment, $5 late fee |

| College Ave | 5.59%–11.99% | 5.59%–11.99% | May charge late fees |

| CommonBond | 5.45%–10.99% | 5.45%–10.99% | $0 origination, $0 prepayment |

Fee Structure and Transparency

One of Earnest’s strongest suits is its transparent fee policy. The lender charges:

- No origination fees

- No prepayment penalties

- No late payment fees

This approach allows borrowers to focus solely on principal and interest, making budgeting and repayment planning more straightforward.

Flexible Repayment Options

Earnest recognizes that borrowers’ financial situations can change, which is why they offer a suite of repayment choices:

- Deferred payment options while in school

- Interest-only payments during school

- Immediate full repayment

- Deferment and forbearance for qualifying hardships

- Customizable payment schedules, where borrowers can select their monthly payment and loan term

This flexibility ensures borrowers can adapt their repayment plan as their needs and circumstances evolve.

Customer Experience and Support

Borrower reviews and testimonials consistently highlight Earnest’s commitment to providing a straightforward, transparent, and supportive lending experience. Many customers note the ease of application and the proactive nature of Earnest’s support channels.

Themes in Customer Reviews and Testimonials

Feedback from borrowers generally centers around a few recurring themes, helping new applicants gauge what to expect:

- Clear and user-friendly online application process

- Frequent updates and transparent communication throughout the loan process

- Helpful and responsive customer service team

- Appreciation for no extra fees and flexible repayment options

- Some frustration regarding eligibility restrictions and the documentation required

Quality of Customer Service and Support Channels

Earnest provides multiple avenues for customer support, including:

- Dedicated phone support with extended hours

- Email and online chat assistance

- Comprehensive self-service resources and FAQs

- Personalized guidance from loan specialists

Borrowers frequently mention the knowledgeable and patient nature of Earnest’s representatives, especially when navigating complex refinancing questions or unique borrower scenarios.

Advantages and Disadvantages Based on Customer Feedback

Comparing the pros and cons as shared by real borrowers can offer valuable perspective:

- Advantages:

- No fees

- Custom repayment plans

- Modern, intuitive digital platform

- Responsive customer support

- Disadvantages:

- Strict eligibility requirements

- Not available in all states

- Limited loan types (primarily education-related)

- Higher credit score needed for best rates

Advantages and Disadvantages of Earnest Loans

Choosing a lender is a major financial decision, and understanding both positive aspects and potential drawbacks of Earnest loans is crucial for borrowers.

Key Benefits of Earnest Loans

Earnest’s approach to lending offers several advantages for student borrowers and refinancers alike. Some of the key benefits include:

- Highly customizable loan terms and payments

- No fees for origination, prepayment, or late payment

- Quick and easy online application

- Transparent, upfront interest rates

- Flexible repayment options, including deferment and forbearance

- Option to skip a payment once every 12 months (for refinancing customers)

Potential Drawbacks or Limitations

Despite its strengths, Earnest may not be the right fit for everyone. Some commonly cited limitations include:

- Eligibility limited to U.S. citizens and permanent residents

- Not available in Nevada (as of 2024) and some other territories

- Minimum credit score and income requirements can exclude some borrowers

- Loan types primarily focused on student loans and refinancing, less variety than some competitors

Side-by-Side Comparison of Pros and Cons

The following table provides an at-a-glance comparison of the most prominent advantages and disadvantages of Earnest loans:

| Pros | Cons | Who Benefits | Who May Not Benefit |

|---|---|---|---|

| Customizable repayments, no fees, fast approval | Strict requirements, limited loan variety, availability issues | Borrowers seeking flexibility and transparency | Applicants with low credit or non-student loan needs |

Real-World Examples and Case Studies

Examining real borrower stories helps illustrate how Earnest’s flexible loan products impact individuals in different financial situations.

Borrower Experiences with Earnest Loans

Many borrowers have shared how Earnest’s approach has positively changed their financial outlook. Consider the following real-world accounts:

“Refinancing my student loans with Earnest dropped my interest rate by over 2%. The process was straightforward, and I loved being able to pick my own payment amount and loan term. The savings have made a real difference in my monthly budget.”

“As a graduate student, I appreciated that Earnest didn’t just look at my credit score. They considered my savings and career plans, which helped me qualify for a favorable rate even though I was just starting out.”

Impact of Earnest Loan Products on Borrowers

Earnest’s customizable options have helped borrowers:

- Pay off debt faster by selecting shorter loan terms

- Reduce monthly payments by extending terms during financial hardship

- Refinance high-interest private and federal loans into a single, manageable payment

- Secure funding as a parent to support a child’s education

Different Use Cases, Earnest loan reviews

Earnest loans are versatile for various scenarios:

- Refinancing Student Debt: Borrowers consolidate federal and private loans, potentially securing a lower rate and simpler repayment.

- New Private Student Loans: Undergraduates and graduates access funds to cover tuition, often with the option for a cosigner.

- Parent Loans: Parents obtain loans on behalf of their children, supporting educational access without burdening the student’s credit.

Alternatives to Earnest Loans

Borrowers exploring student loans and refinancing often compare multiple lenders to find the best fit for their needs. The landscape offers several reputable alternatives, each with distinct features and advantages.

Leading Competitors and Alternative Lenders

The main competitors in the student loan and refinancing market include Sofi, College Ave, Discover Student Loans, and CommonBond. Some have broader product offerings or different underwriting standards, appealing to applicants who may not qualify for Earnest.

Comparison of Alternatives

The table below organizes the primary competitors and highlights what sets each apart:

| Lender | Loan Types | Minimum Rates | Notable Features |

|---|---|---|---|

| Sofi | Student loans, refinancing, personal loans | 4.99% (fixed), 5.29% (variable) | Unemployment protection, career coaching, no fees |

| College Ave | Undergrad, graduate, parent, career loans | 5.59% (fixed & variable) | Flexible repayment, co-signer release, multi-year approval |

| Discover | Private student loans, consolidation | 5.49% (fixed), 5.49% (variable) | Rewards for good grades, no fees |

| CommonBond | Refinancing, private loans | 5.45% (fixed & variable) | Hybrid loans, social impact programs |

Situations Where Alternatives May Be Recommended

Certain borrowers may find a better fit with another lender based on eligibility, loan type, or additional services. For instance, Sofi is attractive for those seeking broader financial products and unemployment protection, while College Ave is known for co-signer release and flexible terms. Discover may be suitable for students who want grade-based rewards, and CommonBond appeals to those interested in social impact.

Tips for Maximizing the Value of an Earnest Loan

Every borrower wants to get the best deal and manage their loan responsibly. Several actionable strategies can help applicants secure favorable terms and streamline their repayment experience with Earnest.

Strategies for Securing the Best Rates and Terms

Lenders reward strong financial profiles, so preparing in advance can lead to more competitive interest rates and approval odds. Consider these practical approaches:

- Improve your credit score by paying down debt and resolving any delinquencies before applying

- Boost your savings and show stable income to demonstrate financial reliability

- Consider applying with a cosigner if your profile needs a boost

- Compare multiple lenders and get prequalified to assess your best options

Improving Approval Chances and Borrowing Experience

A smooth application process starts with preparation and attention to detail. Borrowers can increase their chances of approval by:

- Gathering all necessary documents in advance, such as proof of income and school enrollment

- Accurately reporting financial and educational information on your application

- Responding promptly to any requests from Earnest’s support team

- Reading all terms and conditions carefully before signing any agreement

Responsible Repayment and Loan Management

Managing your loan wisely is essential to maintaining good credit and financial stability. The following steps can help ensure you stay on track:

- Set up autopay to receive potential interest rate discounts and avoid missed payments

- Monitor your loan account regularly using Earnest’s digital dashboard

- Contact customer support early if you anticipate payment difficulties to explore deferment or forbearance options

- Make extra payments whenever possible to reduce principal faster and save on interest

Last Point

In summary, earnest loan reviews provide a clear window into what borrowers can expect when choosing Earnest—highlighting strengths, potential drawbacks, and alternatives in the marketplace. By weighing customer experiences, rates, and support, you can confidently decide if Earnest is the right fit for your loan needs or if a competitor might serve you better. Navigating your financial future starts with understanding the options, and Earnest is a solid contender worth your consideration.

FAQ Overview

Is Earnest a legitimate lender?

Yes, Earnest is a legitimate and well-regarded online lender specializing in student loans and student loan refinancing, backed by a strong reputation for customer service and transparency.

Does applying with Earnest affect my credit score?

Checking your rates with Earnest only requires a soft credit inquiry, which does not impact your credit score. However, submitting a full application involves a hard credit check, which may have a minor effect.

What credit score do I need for an Earnest loan?

While Earnest considers factors beyond just your credit score, borrowers typically need a minimum score of around 650 to qualify for most loans.

Can I refinance both federal and private student loans with Earnest?

Yes, Earnest allows you to refinance both federal and private student loans into a single loan with new terms and interest rates.

How long does it take to get approved by Earnest?

The approval process usually takes a few days to a week, depending on how quickly you provide required documentation and how complex your application is.