earnest education loan simplifies student borrowing

earnest education loan sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Whether you’re a first-time borrower or exploring new ways to finance your studies, Earnest brings a refreshing approach to education loans tailored to modern students’ needs.

At its core, the earnest education loan is designed to make student financing transparent, flexible, and accessible. With unique features like customizable repayment terms, competitive interest rates, and a user-friendly application process, Earnest stands apart from traditional lenders. Borrowers who value flexibility and a straightforward experience often find Earnest an appealing option for funding undergraduate, graduate, and professional studies at a wide variety of accredited institutions.

Introduction to Earnest Education Loan

Earnest education loans are private student loans designed to help students and their families cover the costs of higher education when federal aid or personal savings fall short. These loans are tailored for undergraduate and graduate students seeking flexible repayment options and competitive interest rates. Earnest positions itself as a user-friendly lender emphasizing personalization, transparency, and technology-driven solutions.

Earnest student loans are distinguished by their customizable repayment plans, lack of fees (like origination, prepayment, or late fees), and a unique approach to underwriting that takes into account each applicant’s full financial profile, not just credit score. Their digital-first process makes applications straightforward, aiming to reduce stress for both students and parents.

The borrowers who typically choose Earnest for education financing are those who want flexibility, transparency, and control over their loan experience. This includes undergraduates, graduate students, and parents who wish to take out loans on behalf of their children.

Primary Features of Earnest Student Loans

Before choosing a lender, understanding what sets Earnest apart helps borrowers find the right fit for their financial needs. Here are some defining characteristics of Earnest education loans:

- Customizable repayment terms ranging from 5 to 15 years

- No fees for origination, prepayment, or late payments

- Skip-a-payment and flexible due date options

- Comprehensive underwriting considering income, savings, work history, and education

- Entirely online application and loan management process

- Options for both undergraduate and graduate degrees

Typical Borrowers Choosing Earnest

Earnest loans attract a diverse range of students and families who value a technology-driven experience and flexible repayment. Borrowers often include:

- Students attending four-year colleges or pursuing advanced degrees

- Parents seeking to support their children’s education without federal loan restrictions

- Borrowers with strong financial profiles looking for lower rates and personalized terms

Eligibility Criteria for Earnest Education Loan

Qualifying for an Earnest education loan involves meeting specific requirements to ensure responsible lending. Understanding these criteria helps applicants assess their readiness and gather necessary documents before applying.

Basic Application Requirements

Earnest requires borrowers to be U.S. citizens or permanent residents, enrolled at least half-time in a Title IV–accredited institution. The applicant must be of legal age in their state and must reside in a state where Earnest lends (as of 2024, available in most states except Nevada). Meeting these requirements is essential for the application to be considered.

Credit Score and Income Prerequisites

Financial responsibility is crucial when applying for a private student loan. Earnest evaluates applicants holistically but maintains minimum thresholds, especially for credit score and income. The following table summarizes these key eligibility criteria:

| Requirement | Description | Minimum Value | Notes |

|---|---|---|---|

| Credit Score | FICO credit score measured for primary or cosigner | 650 | Higher scores may qualify for lower rates |

| Income | Stable, verifiable annual income | $35,000 | Cosigner’s income considered if applicable |

| Residency | U.S. citizen or permanent resident | N/A | Must reside in eligible state |

| Enrollment | Enrolled at least half-time in eligible school | Half-time | Must be Title IV–accredited |

Educational Institutions and Programs Supported

Earnest supports loans for students attending accredited Title IV institutions, which include most four-year colleges, universities, and eligible graduate programs in the United States. Programs range from undergraduate degrees to master’s, law, and select professional studies, with some flexibility based on the school’s credentials. Applicants should confirm their program is recognized by Earnest before applying.

Application Process for Earnest Education Loan

The application process for an Earnest education loan is designed to be streamlined and accessible. By following a clear set of steps and preparing necessary documentation, applicants can ensure a smooth and efficient experience from start to finish.

Step-by-Step Application Procedure

Applicants begin the process online, which allows for quick prequalification and a transparent overview of potential terms. Each step is intended to minimize guesswork and provide clarity at every phase.

- Check eligibility and prequalify with a soft credit inquiry.

- Compare personalized loan options and select desired terms.

- Fill out the full application and provide detailed personal, school, and financial information.

- Upload required documents and submit the application for review.

- Wait for certification from the school to verify enrollment and financial need.

- Receive a final decision and electronically sign the loan agreement if approved.

- Funds are disbursed directly to the school according to their payment schedule.

Required Documents and Information

To accelerate the application review, it’s important to gather all necessary documents in advance. This supports a quicker and more accurate decision by Earnest’s underwriting team.

- Government-issued photo ID (driver’s license, passport, etc.)

- Social Security number

- Proof of income (recent pay stubs, tax returns, or offer letter)

- School enrollment verification or acceptance letter

- Cosigner’s information and financial documents (if applicable)

- Details of requested loan amount and cost of attendance

Tracking Application Status

After applying, borrowers can easily check their application status by logging into their Earnest online dashboard. The dashboard displays progress updates, pending documentation requests, and next steps, ensuring applicants are always informed about their loan’s journey from submission to funding.

Loan Terms and Interest Rates: Earnest Education Loan

Earnest offers a range of loan terms and interest rate options to match the diverse needs of student borrowers. Understanding these options helps borrowers make informed repayment choices that fit their budgets and long-term goals.

Available Loan Terms and Repayment Periods

Borrowers can choose repayment periods ranging from 5 to 15 years, giving them control over both monthly payments and total interest costs. Shorter terms lead to higher monthly payments but save on interest, while longer terms offer lower payments with more total interest paid over time.

Fixed vs Variable Interest Rates

Earnest allows applicants to select between fixed and variable interest rates. The following table highlights key differences to help borrowers decide which is best for their financial situation:

| Rate Type | Interest Range | Pros | Cons |

|---|---|---|---|

| Fixed | 5.19% – 14.90% APR* | Predictable monthly payments; no change over life of loan | Usually starts higher than variable rates |

| Variable | 5.89% – 14.14% APR* | Can save money if rates stay low; may start lower than fixed | Payments can increase as market rates rise |

*Actual rates may vary based on applicant’s credit, chosen term, and prevailing market conditions as of early 2024.

Interest Accrual and Calculation, Earnest education loan

Interest on Earnest student loans is calculated using simple daily interest, based on the outstanding principal and the selected annual percentage rate (APR). Interest starts accruing as soon as funds are disbursed to the school, even if the borrower is enrolled in school or a deferment period. Early payments can help reduce the total cost of the loan by minimizing accrued interest.

Repayment Options and Flexibility

Earnest is recognized for its borrower-centric repayment options, offering flexibility that adapts to students’ post-graduation circumstances. This flexibility is designed to reduce financial pressure and help borrowers manage their payments with confidence.

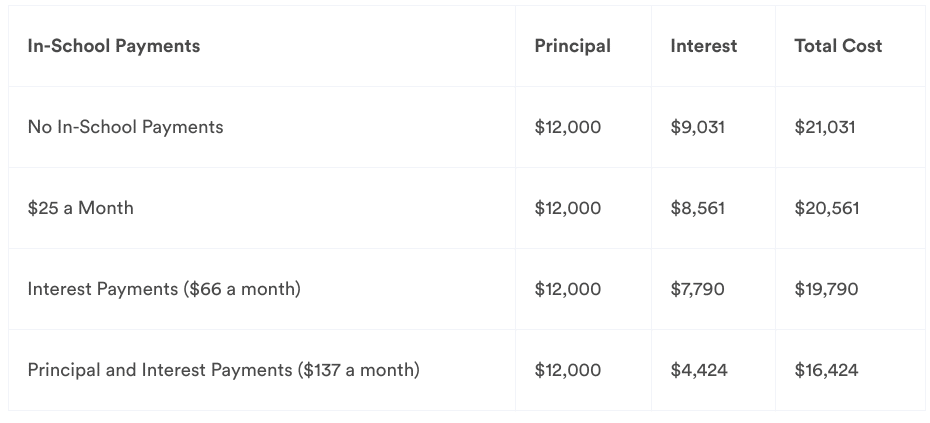

Repayment Plan Options

Borrowers can choose from several repayment plans that fit their unique financial situations and goals. Each option has specific benefits regarding monthly payment amounts and total interest paid.

- Immediate Repayment: Begin making full principal and interest payments right after funds are disbursed.

- Interest-Only Repayment: Pay only the interest while in school and during the grace period, with principal payments starting after graduation.

- Fixed $25 Payment: Make small, fixed payments while in school to reduce interest accrual.

- Deferred Repayment: Postpone payments until after graduation or leaving school, with interest accruing during in-school and grace periods.

Unique Features for Payment Flexibility

Earnest sets itself apart with features that provide additional breathing room for students and recent graduates. These include:

- Option to skip one payment every 12 months (with no penalty)

- Ability to customize monthly payment dates

- No fees for early or extra payments

- Grace period of nine months post-graduation (longer than the industry standard)

- Customizable repayment term selection for optimal budget alignment

Flexible repayment options empower students and graduates to better manage life transitions, reduce financial stress, and pay down debt with greater confidence—making it easier to adjust as circumstances change.

Benefits and Drawbacks of Earnest Education Loans

Evaluating both the strengths and limitations of Earnest education loans is critical before making a decision. These aspects can greatly impact the overall borrowing experience and long-term financial health.

Comparison Table: Benefits vs Drawbacks

A clear comparison helps in understanding where Earnest excels and where borrowers might encounter challenges.

| Benefits | Drawbacks |

|---|---|

| Customizable repayment terms and due dates | No access to federal loan forgiveness or income-driven repayment |

| No origination, prepayment, or late fees | Must meet stricter credit and income requirements than federal loans |

| Skip-a-payment feature and extended grace period | Interest accrues during deferment and forbearance |

| Competitive interest rates for qualified borrowers | Not available in all states (e.g., Nevada) |

| User-friendly digital platform and fast application process | Cosigner may be required for those with limited credit/income |

Benefits Compared to Federal Student Loans

While Earnest offers greater flexibility and tailored repayment options, borrowers forgo federal protections like income-driven repayment, loan forgiveness, and certain subsidized interest benefits. However, for those who do not qualify for enough federal aid or want customized terms, Earnest can provide a valuable alternative.

Limitations and Restrictions to Consider

Applicants should be aware of some limitations, such as stricter eligibility requirements, limited availability by state, and the absence of federal loan perks. Carefully reviewing all terms and considering personal financial circumstances is advised before proceeding with a private loan from Earnest.

Cosigner Policies and Options

Cosigners can play a significant role in qualifying for an Earnest education loan, especially for students with limited credit history or insufficient income. A cosigner is typically a parent, guardian, or trusted adult who shares the legal responsibility for loan repayment.

Role of a Cosigner and When Required

The presence of a cosigner can strengthen a loan application, potentially securing a lower interest rate and increasing approval odds. Earnest may require a cosigner if the primary applicant does not meet minimum credit or income requirements, or has a limited credit history.

Cosigner Criteria and Responsibilities

A cosigner must demonstrate financial stability and willingness to share responsibility for the loan. Key criteria and responsibilities include:

- Must be a U.S. citizen or permanent resident

- Meet minimum credit score and income thresholds (often mirroring the primary applicant’s requirements)

- Legally obligated to repay the debt if the student is unable to pay

- Impact on their credit report and debt-to-income ratio

Cosigner Release Policies and Steps

Earnest recognizes that students may become financially independent over time. The lender offers cosigner release options after consistent, on-time payments. Typical steps include:

- Make a set number of consecutive, on-time principal and interest payments (usually 36 months minimum)

- Demonstrate sufficient credit and income to qualify independently

- Submit a formal cosigner release application to Earnest

- Undergo a credit review process to confirm eligibility

Customer Support and Resources

Borrowers have access to a variety of support channels and educational resources that enhance the Earnest loan experience. These tools are designed to guide applicants through the borrowing process and help them make informed decisions.

Available Customer Service Channels

Earnest provides multiple ways for borrowers to get help and answers to their questions. Customer support is available through:

- Email support for general inquiries and documentation

- Phone support with dedicated hours on weekdays

- Live chat via the Earnest website for quick assistance

- In-app messaging for current borrowers

Typical support hours are Monday through Friday, 8 a.m. to 5 p.m. PT, with extended hours during peak application periods.

Support Resources Overview

Borrowers and applicants can utilize various resources to assist them throughout the loan process and beyond.

| Resource Type | Access Method | Target Audience | Key Features |

|---|---|---|---|

| Online Knowledge Base | Website | Applicants & Borrowers | FAQs, process explanations, troubleshooting guides |

| Loan Calculators | Website tools | Applicants | Monthly payment and total cost estimations |

| Educational Blog | Website | Students & Families | Financial literacy articles, budgeting tips, student success stories |

| Personalized Application Support | Email, Phone, Chat | Applicants | Step-by-step guidance, document review, eligibility checks |

Educational Tools and Calculators

Earnest offers interactive repayment calculators and budget planners to help students forecast loan payments and assess their borrowing needs. These tools empower applicants to compare different loan scenarios, visualize long-term costs, and make confident, informed choices about their educational financing.

Final Conclusion

Choosing earnest education loan means embracing a lending experience that prioritizes your financial well-being and adaptability throughout your academic journey. From supportive customer service to flexible repayment options, Earnest aims to empower students and graduates to reach their goals without unnecessary financial stress. As you consider your borrowing choices, let the knowledge of Earnest’s advantages and thoughtful policies guide your next steps with confidence.

Frequently Asked Questions

Is there a penalty for early repayment with an earnest education loan?

No, Earnest does not charge any prepayment penalties, so you can pay off your loan early without extra fees.

Can I apply for an earnest education loan without a cosigner?

Yes, if you meet Earnest’s credit and income requirements, you can apply without a cosigner, but having one can improve your chances and may help you get a lower rate.

How long does it take to get approved for an earnest education loan?

Most applicants receive an initial decision within a few business days, but the full process may take a week or more depending on document verification and school certification.

Does Earnest offer loans for part-time students?

Earnest typically requires borrowers to be enrolled at least half-time at an eligible institution, but you should check their latest eligibility criteria for updates on part-time student options.

Are international students eligible for earnest education loans?

Currently, Earnest loans are generally available to U.S. citizens and permanent residents, so international students may not qualify unless they apply with an eligible cosigner.