rocket mortgage conventional loan a smart choice for homebuyers

Rocket mortgage conventional loan leads the way for modern homebuyers seeking a seamless and flexible mortgage experience. From your first inquiry to closing day, this option is designed to simplify the process and offer clear advantages for qualifying borrowers.

With Rocket Mortgage, applicants gain access to a range of conventional loan products, each tailored to meet diverse financial needs and homeownership goals. The digital platform streamlines everything from application and document uploads to communication and progress tracking, while competitive rates, helpful resources, and dedicated support create a comprehensive lending journey.

Overview of Rocket Mortgage Conventional Loan

Rocket Mortgage is a leading online mortgage lender known for streamlining the home loan process, especially for conventional loans. Their conventional loan offerings cater to a wide range of homebuyers, from first-time purchasers to those refinancing their existing mortgages. With a digital-first approach, Rocket Mortgage emphasizes convenience, transparency, and user control throughout the lending journey.

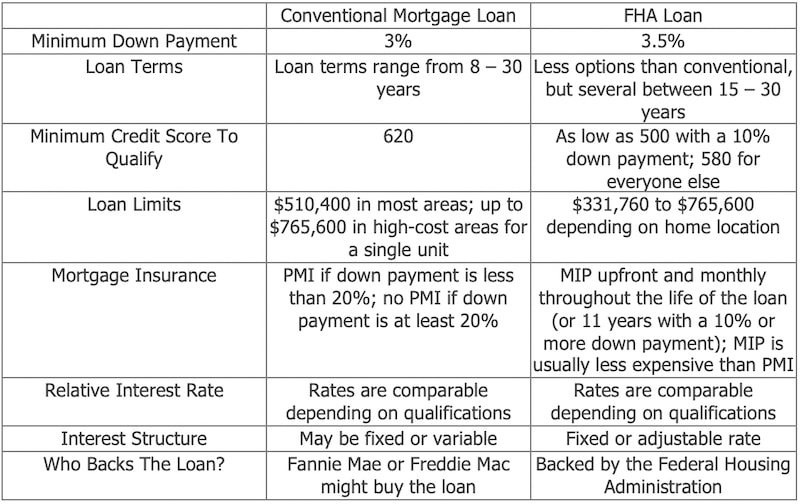

Conventional loans from Rocket Mortgage are not insured by the federal government, which means qualifying borrowers may benefit from competitive interest rates, flexible terms, and fewer restrictions on property types. These loans are suitable for individuals with solid credit histories and stable finances who seek straightforward, customizable options.

Main Features and Benefits

Rocket Mortgage conventional loans offer several appealing features for borrowers seeking flexibility and efficiency:

- Competitive interest rates compared to government-backed loans

- Highly streamlined digital application and approval process

- Wide range of fixed-rate and adjustable-rate terms

- No upfront mortgage insurance premiums for eligible borrowers

- Option to eliminate private mortgage insurance (PMI) once equity threshold is reached

- Pre-approval and conditional approvals available within minutes

- Dedicated mortgage experts available to assist throughout the process

Eligibility Requirements

Unlike government-backed programs, Rocket Mortgage requires borrowers to meet specific guidelines to qualify for its conventional loans. These criteria ensure responsible lending and lower risk for both the borrower and lender.

- Minimum credit score of 620 (may be higher for certain loan types)

- Stable income and employment history, typically two years or more

- Debt-to-income (DTI) ratio generally below 45%

- Down payment as low as 3% for select programs

- Property must meet appraisal and occupancy standards

Loan Process and Timeline

The Rocket Mortgage process is designed for speed and transparency, leveraging technology to reduce paperwork and wait times. Applicants can expect a straightforward timeline:

- Online Pre-Approval: Instant decision in most cases after submitting financial details.

- Full Application: Complete digital application and upload supporting documents through the platform.

- Processing and Underwriting: Automated systems and mortgage experts review your application, verify information, and order an appraisal.

- Loan Approval: Receive a formal commitment letter after meeting all conditions.

- Closing: Electronically sign closing documents; most loans close within 30 days, sometimes faster for well-prepared borrowers.

Types of Conventional Loans Offered by Rocket Mortgage

Rocket Mortgage offers a diverse selection of conventional loan products to fit a variety of financial needs and homeownership goals. These options provide flexibility for first-time homebuyers, those looking to refinance, and buyers interested in investment or vacation properties.

Each loan type comes with specific features, down payment requirements, and borrower profiles, making it possible to tailor your mortgage to your unique circumstances.

Conventional Loan Products Overview

The table below summarizes the key types of conventional loans available from Rocket Mortgage, along with important details for comparison.

| Loan Name | Minimum Down Payment | Max Loan Limit (2024) | Ideal Borrower Profile |

|---|---|---|---|

| Standard Conventional | 3%-5% | $766,550 (varies by location) | First-time & repeat buyers with solid credit |

| Conventional 97 | 3% | $766,550 | First-time homebuyers seeking low down payment |

| HomeReady/Home Possible | 3% | $766,550 | Low-to-moderate income borrowers, flexible sources for down payment |

| Jumbo Conventional | 10%-20% | Above $766,550 | High-income borrowers, purchasing high-value homes |

| Refinance Conventional | N/A | Based on equity & loan type | Existing homeowners seeking better rates or terms |

Unique Features and Special Loan Options, Rocket mortgage conventional loan

Rocket Mortgage stands out by offering digital convenience, rapid approvals, and specialty loan options tailored for modern borrowers.

- Exclusive digital mortgage process with real-time status tracking

- Customized loan packages for investment properties and second homes

- Enhanced flexibility for freelance and gig-economy workers (with documentation)

- Automated asset and income verification tools

Qualification Criteria and Documentation

Qualifying for a Rocket Mortgage conventional loan requires meeting several key financial benchmarks. These criteria help ensure responsible lending and protect both borrower and lender interests. Understanding the qualification process can help applicants prepare a stronger application and increase their chance of approval.

Basic Qualification Requirements

Rocket Mortgage evaluates applicants based on creditworthiness, stable income, and manageable monthly debt. Meeting these requirements is essential to receive favorable terms and interest rates.

- Credit score: Minimum 620; higher scores improve approval chances and lower rates.

- Debt-to-Income Ratio: Typically below 45%; lower DTI preferred for best terms.

- Stable Employment: Two years of consistent work and verifiable income.

- Down Payment: 3% minimum for select loans; higher down payment may reduce PMI.

Required Documentation

Applicants should be prepared to provide detailed documentation supporting their financial status. These documents are essential for verifying eligibility and processing the loan efficiently.

- Recent pay stubs (last 30 days)

- W-2 forms and/or 1099s (last two years)

- Federal tax returns (last two years)

- Bank statements (last two months)

- Proof of additional income (if applicable)

- Photo identification (driver’s license or passport)

- Authorization for credit check

Rocket Mortgage Evaluation Process

Rocket Mortgage employs a combination of automated technology and expert review to assess borrower eligibility. This dual approach ensures accuracy and speed.

- Automated underwriting systems perform initial eligibility checks using submitted documentation and credit data.

- Mortgage professionals review edge cases or complex profiles for further evaluation.

- Real-time updates notify borrowers of missing items or additional requirements, making it easy to track progress online.

- Once all criteria are satisfied, a commitment letter is issued, moving the loan toward closing.

Down Payment and Private Mortgage Insurance (PMI) Policies

Down payment requirements and the presence of private mortgage insurance (PMI) are two critical factors in determining the affordability of a Rocket Mortgage conventional loan. These factors influence monthly payments, overall loan costs, and long-term equity growth.

Minimum Down Payment Requirements

Rocket Mortgage offers flexible down payment options designed to accommodate a range of financial situations. While a higher down payment can reduce borrowing costs, eligible borrowers can secure a home with as little as 3% down.

- 3% minimum for first-time buyers and select loan programs

- 5% or more for most standard conventional loans

- 10%-20% for jumbo loans or investment properties

- Higher down payment may eliminate PMI and improve loan terms

Private Mortgage Insurance and Removal Process

When the down payment is less than 20%, Rocket Mortgage requires PMI to protect the lender. However, borrowers have opportunities to remove PMI as they build equity:

- PMI is typically required until the home’s equity reaches 20%.

- Borrowers can request PMI removal once they’ve paid down the loan to 78%-80% of the home’s original value.

- Automatic PMI cancellation occurs at 78% loan-to-value (LTV), as regulated by federal law.

- Appraisals or updated property valuations may be required for early PMI cancellation.

Down Payment and PMI Comparison Table

The following table Artikels how different down payment percentages affect PMI requirements with Rocket Mortgage:

| Down Payment Percentage | PMI Required | PMI Removal Process |

|---|---|---|

| 3% – 4.99% | Yes | Request removal at 20% equity; automatic at 22% equity |

| 5% – 19.99% | Yes | Request removal at 20% equity; automatic at 22% equity |

| 20% or more | No | N/A |

Interest Rates, Fees, and Loan Terms

Interest rates, fees, and loan terms are crucial elements of any mortgage decision. Rocket Mortgage offers competitive rates and a variety of terms to suit different borrower profiles while disclosing all associated costs up front. Understanding these aspects can help borrowers make informed decisions and avoid surprises at closing.

Interest Rates and Loan Terms Overview

Rocket Mortgage provides both fixed-rate and adjustable-rate conventional loans. Fixed-rate loans offer predictable monthly payments, while adjustable-rate mortgages (ARMs) start with lower initial payments that can change over time.

- Fixed-rate terms: Typically available in 15, 20, and 30-year options

- Adjustable-rate terms: Commonly offered as 5/1, 7/1, or 10/1 ARMs

- Interest rates: Based on credit profile, loan type, and current market conditions

- Discount points available for buyers seeking to lower their rate

Fees and Rate Lock Options

Rocket Mortgage is transparent about its fee structure, ensuring borrowers understand all costs before closing. They also provide flexible rate lock options to protect against rising interest rates during the application process.

- Origination fee: Typically 0.5% – 1% of the loan amount

- Appraisal, credit report, and processing fees may apply

- Rate lock periods: 45, 60, or even 90 days, with options to float down if rates improve

- No prepayment penalties for paying off your loan early

Loan Terms and Costs Comparison Table

The following table highlights typical interest rates, terms, and fees for Rocket Mortgage conventional loans (rates are illustrative and may change with market conditions):

| Loan Term | Interest Rate Range (2024 est.) | Fees | Rate Lock Options |

|---|---|---|---|

| 30-Year Fixed | 6.5% – 7.2% | Origination, appraisal, processing | 45/60/90 days, float down available |

| 15-Year Fixed | 5.8% – 6.5% | Origination, appraisal, processing | 45/60/90 days, float down available |

| 5/1 ARM | 5.9% – 6.8% (initial) | Origination, appraisal, processing | 45/60/90 days, float down available |

Application Process and Online Experience

The hallmark of Rocket Mortgage’s success is its fully digital application platform, designed to simplify every step of the mortgage journey. This platform empowers borrowers to control their home loan process from anywhere, offering clarity and convenience at every turn.

Step-by-Step Application Process

Rocket Mortgage breaks down the mortgage application into clear, manageable steps, allowing borrowers to progress at their own pace.

- Account creation and secure login to Rocket Mortgage portal

- Pre-approval by providing basic financial information

- Document upload for income, assets, and identification (all online)

- Application review and real-time feedback on missing or incomplete items

- Automated underwriting and, if needed, supplemental documentation requests

- Final approval, digital closing, and e-signature of documents

User Interface and Digital Tools

Borrowers benefit from an intuitive user interface packed with helpful features tailored for hassle-free mortgage management.

- Dashboard shows real-time loan status and outstanding tasks

- Secure document upload and sharing tools

- Integrated calculators for payment estimates and affordability checks

- Direct messaging and phone access with loan experts

- Notifications via email, SMS, or app for status updates

Advantages of the Online Experience

Rocket Mortgage’s digital-first approach offers key benefits over traditional mortgage processes, enhancing the borrowing experience significantly.

- Faster pre-approval and streamlined application reduces time to close

- Document uploads and status tracking available 24/7

- Minimized paperwork and in-person meetings required

- Clear, transparent communication with knowledgeable support staff

- Mobile access for on-the-go management

Comparison: Rocket Mortgage Conventional Loans vs. Other Lenders

When comparing Rocket Mortgage to traditional banks and credit unions, several differences stand out in terms of technology, speed, flexibility, and borrower experience. Evaluating these distinctions can help borrowers determine the best fit for their mortgage needs.

Comparison Table: Lender Features and Benefits

The following table summarizes how Rocket Mortgage stacks up against other lending options on critical criteria:

| Lender | Interest Rate (est.) | Min. Down Payment | Unique Benefits |

|---|---|---|---|

| Rocket Mortgage | 6.5% – 7.2% | 3% | Instant online pre-approval, digital application, fast closing |

| Traditional Bank | 6.3% – 7.0% | 5% | In-person service, wider range of financial products |

| Credit Union | 6.0% – 6.9% | 3% – 5% | Lower fees for members, personalized service |

Situations Favoring Rocket Mortgage

Certain scenarios make Rocket Mortgage an especially attractive or less optimal choice for borrowers.

- Best for tech-savvy borrowers seeking speed, convenience, and transparency

- Competitive for first-time homebuyers needing low down payments and digital ease

- Not ideal for applicants who value extensive in-person interaction

- May be less favorable if seeking exclusive credit union member discounts or bundled banking products

Final Conclusion

Choosing Rocket Mortgage for your conventional loan means enjoying the benefits of a user-friendly digital experience, personalized options, and reliable support. Whether you’re a first-time buyer or a seasoned homeowner, Rocket Mortgage’s offerings can provide the flexibility and transparency needed to achieve your real estate dreams with confidence.

Commonly Asked Questions

What is a Rocket Mortgage conventional loan?

It’s a home loan offered by Rocket Mortgage that follows standard guidelines set by Fannie Mae and Freddie Mac, without government backing.

Can I apply for a Rocket Mortgage conventional loan online?

Yes, the entire process—from pre-approval to closing—can be completed online through Rocket Mortgage’s digital platform.

What credit score do I need for a Rocket Mortgage conventional loan?

Generally, you’ll need a minimum credit score of 620, but a higher score may qualify you for better rates and terms.

Is there a minimum down payment required?

Yes, Rocket Mortgage conventional loans typically require a minimum down payment of 3% to 5% depending on your specific loan product and qualifications.

When can I remove PMI on a Rocket Mortgage conventional loan?

PMI can usually be removed once your home equity reaches 20%, either through payments or increased property value, subject to lender approval.

Does Rocket Mortgage offer rate locks for conventional loans?

Yes, borrowers can lock in their interest rate for a specified period during the application process.

What support is available if I have questions during the loan process?

Rocket Mortgage provides customer support via phone, chat, and email, as well as online resources and guides for borrowers at every step.